This past weekend I went to the Real Estate Wealth Expo in San Mateo. They had a 2-for-1 deal on VIP tickets, which ended up being around $53 for each ticket. I also purchased a single VIP ticket as a gift for a friend at $75, but he couldn’t make it so I ended up reselling his ticket for $50. On Groupon I noticed they were selling Gold tickets for around $40, but I got the VIP ticket thinking maybe it would be of better value. If this expo is happening in your city, you may be better off just getting the gold ticket as people moved around a lot and it didn’t seem like that big of a deal whichever ticket you got (though most people were VIP).

Some friends and I at the event

To be 100% honest I don’t think I would attend the event again in the future.

The event has some big names including Tony Robbins, Christina El Moussa, Magic Johnson, Pitbull, Grant Cardone, and Daymond John, and I would say that’s the only really cool part of the show.

Christina El Moussa from Flip or Flop

But if you want to actually learn more about real estate investment, I don’t think this is the place to do it. Regardless, here are some notes and thoughts on the Real Estate Wealth Expo in San Mateo!

Review of the Real Estate Wealth Expo in San Mateo (2018)

The standard layout of each seminar went like this: the speaker would give you a background story about how they grew up and how broke or uneducated they were. But then they would show you their current extravagant life after the investment they implemented. The speaker would hit you with a spiel saying you don’t need an education, you don’t need money, you can do this wherever you want, on the beach or at home, and they would repeat some hype words like “say YES if you would like that!”

Then they give you what the retail value is on the course/workshop/membership, which is usually in the thousands of dollars range, and then they tell you they’ll provide a limited time, exclusive offer of $997, which can only be purchased today at the expo. Somehow tons of people were buying into it and signing up, so maybe I’m just sipping that haterade. If you’re about it, then check out the event. But for me, I like to learn about how things are done, what the process is, how much work is put in, and I would like to get to know the person advocating whatever they’re advocating. Then I would be able to go in trusting that the purchase would allow me to come out the other side gaining new knowledge and actual results. For example, one of the seminars I went to had some information about tax liens investing and the information was appealing, but I looked up reviews of the bundle they were selling, and I saw a bunch of people saying “BEWARE”! I’m just cautious of sales pitches especially when they’re formatted in such a way, because you never know if what they’re selling is garbage.

Ultimately I don’t think you’d really learn too much if you went to the Real Estate Wealth Expo (I believe there are a few more happening in different cities). You might get a little bit of information if you have zero idea on different investing techniques, but if you already have some knowledge you’re probably not going to learn anything new. All these reviews online of the Real Estate Wealth Expo are saying it already, that if something seems too good to be true, then it probably is.

On the positive side: if you want to see some big names speak, I have to admit they say some inspirational stuff – I actually really enjoyed Tony Robbins’ part so I’m pretty happy I stayed for that. I’m going to make another blog post about my notes on his section. Another valuable opportunity is you may be able to network and meet a lot of good contacts for whatever you’re looking for. So if you’re a real estate investor it might be worthwhile to chat with people in the sector. But then again I had some friends check out the speed networking section in the morning and didn’t really get much out of it.

Just be cautious that the event might not be all that you think it will be if you’re expecting to learn a lot. And be prepared to hear a lot of sales pitches.

Because of all this, I actually ended up not even attending the second day (though I was slightly interested in hearing Pitbull speak).

Expo Notes

I brought my laptop to the event so I took some notes on the seminars that I actually attended. As a disclaimer these are just my notes on what the speakers said, which may or may not be accurate – consult a financial advisor if you actually want to jump in on some serious investing, and this site and author are not responsible for any investing decisions you might make :). As mentioned earlier, I will put Tony Robbins’ notes on a different blog post as I jotted down a lot for his portion.

Brian Allen – Real Estate Flipping & Funding Notes

90% of millionaires became so through owning real estate.

3 keys to real estate success:

- Find the right property

- Getting the funding to do the deal

- Exit strategies – making money

Traditional real estate investing entails:

Visit Zillow/Trulia/Realtor for deals and go to the bank.

- First you need to get pre-approved which takes around 30 days.

- You’ll need at least 700 credit score.

- You’ll need a 20% down payment.

- Find distressed properties at wholesale prices

- Figure out if you want to fix and flip or buy and hold

- Find a buyer

An alarming 37% of middle class Americans think they have to work until they’re too sick or until they die. But you have to step out of your comfort zone to create wealth. Invest in yourself.

“You have 18 months to 2 years to either watch…or participate in the greatest buying market since the great depression.” – Warren Buffet on real estate investing.

And then….insert Brian’s sales pitch on his course…he was pitching that you can use other people’s money to fund your real estate investments, and he would show you how.

Brian Allen. I didn’t sit that close so sorry for all these screens lol.

Stephen John – Tax Lien Properties Notes

TAX LIEN

A first position lien is placed on a property due to delinquent property taxes. If you don’t pay your taxes you’ll get a first lien.

Tax Lien Model

One example: A property at $200k FMV (fair market value) with $1800 per year property taxes

When the owner can’t pay their property taxes, the government will put a first tax lien on it. As an investor, you would pay the county the $1,800 tax lien, and the county would give you a tax lien certificate. If the owner doesn’t pay the taxes within the redemption period, ($1,800) they lose the house. When you buy the tax lien you have to wait the redemption period – you don’t own the property. The redemption period can be around 6 months to 4 years depending on where the property is located, and the homeowner has that time to pay back the property taxes.

About 35% homeowners in US own their house free & clear.

90% of the time or more, the homeowner or the bank WILL pay the back taxes so instead of getting the property, you would get your money back plus interest. 10% of the time you‘ll get the house free and clear. The speaker believed that as long as you buy 10 tax liens, one of those will turn into a free and clear property.

3 reasons why the homeowner may not pay their property taxes:

- The homeowner is deceased

- They receive the tax bill to their house and they no longer live there

- They don’t have the money

2 reasons why bank doesn’t pay (there was a 3rd reason he mentioned but I missed it):

- The property is upside down (they owe too much and it’s in a bad area)

- Too many liabilities in their books and banks are allowed to write off properties

In some counties you need to buy tax liens a million at a time, which is one reason why not everyone is investing in it.

Stephen provided some stats around how much you could make with investing in tax liens but I’m not going to insert them cause I feel like they give false, exciting expectations. If you end up wanting to try out this route, make sure you do your due diligence because when I look it up online, people say it can be pretty risky. For example, you might buy a tax lien and wind up getting stuck with a really crappy property or a lot of land that ends up being a liability. He started pitching the “Tax Lien Buyers Club” – but I don’t trust it because of articles like this.

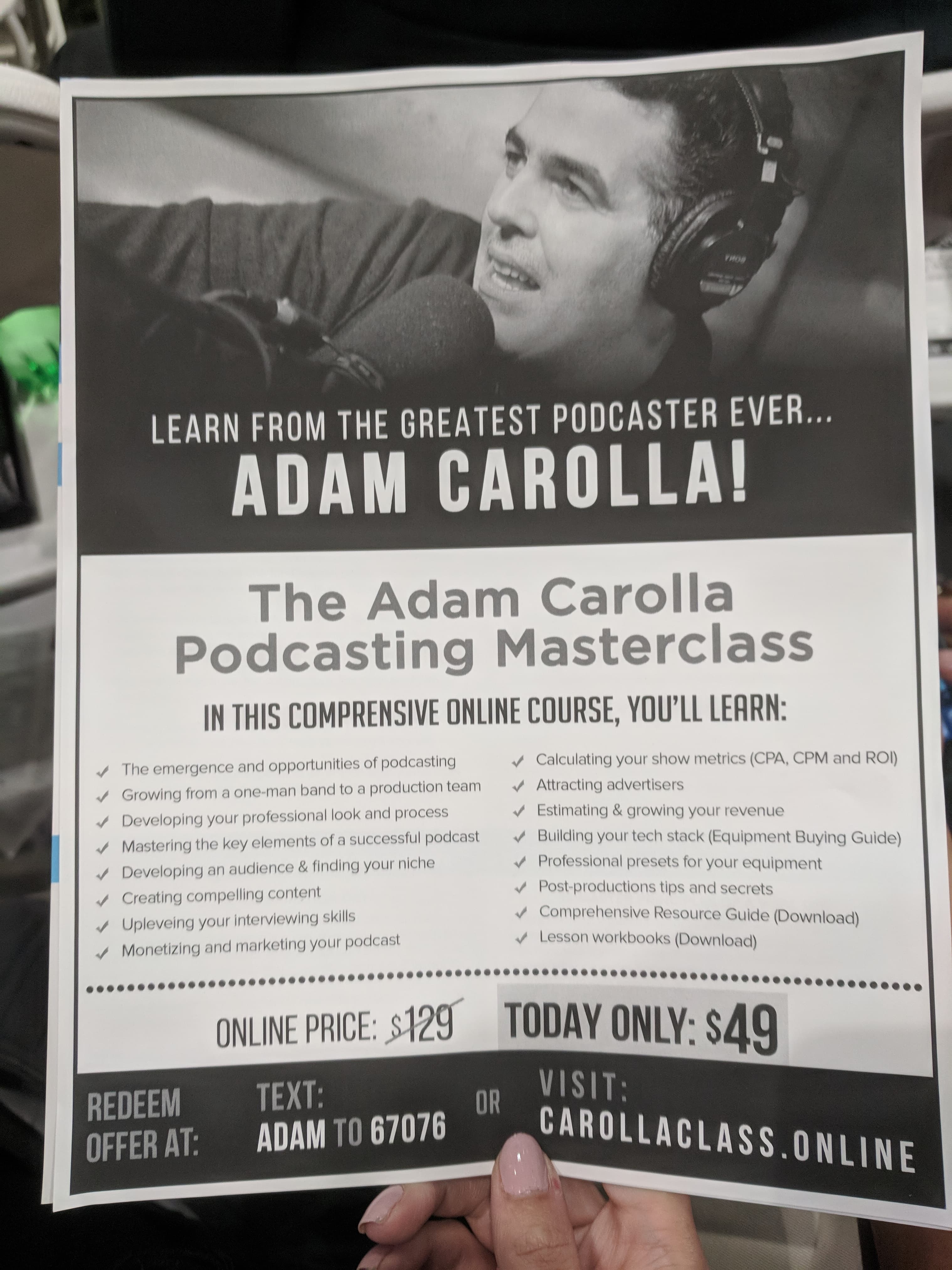

Adam Carolla – Do What You Love

I kind of liked what Adam Carolla had to say. He’s actually a comedian, but he said some inspirational stuff about the entrepreneurial journey.

Don’t think about what’s at the end. When he started his journey as a comedian, he never talked about money. Him and his partner/team just talked about collaborating, working, and doing what they loved. It’s all about the process rather than the goal, and he had no idea it was going to succeed.

It was unheard of to make money podcasting 10 years ago – so we forget how privileged we are to have this opportunity, and we should really milk it.

Adam said he was “behind” from 0 to 30, and he wanted to show this by providing his social security statement, which I thought was funny. I decided to type it out cause I thought it might be interesting for you guys to see.

Social Security Statement

On the left is the year, and on the right is the amount he earned that year.

1980 $232

1981 $746

1982 $1093

1983 $2289

1984 $9367

1985 $0

1986 $17,672 – he was getting paid $19.50 an hour doing a regular job, and in 1986 it was pretty good

1987 $2,553 – he wasn’t happy with “okay” so he tried comedy (something he likes and that he’s good at)

1988 $0

1989 $22,543

1990 $6,312

1991 $0

1992 $3,521 – he attended his high school reunion and said it was pretty bad and laughed at how embarrassing it was.

1993 $3984

1994 $6442 (age 30)

After high school Adam went from carpet cleaning to “laborer”. The reason why he’s become successful now is that at about age of 21 years old, he stopped and thought “wait a minute. I don’t want to go through my whole life this way. I don’t want to work for someone else. I want more.” And he asked himself, “What are you good at?” and realized that he’s good with his hands and is funny. So he decided he would try comedy.

Adam never had lofty dreams. His dream was make a living NOT swinging a hammer or holding a shovel. He never thought about getting rich. He said to just think about getting paid to do what you love, and ask yourself “what would you do for free”? He mentioned how far we would be ahead of humanity if we did what we would do for free – and got paid for it.

He was uncomfortable with his living situation, and he talked to the crowd saying, “some of you are comfortable with where you are in life. The benefits are okay, money is okay, perks are okay. Sort of a velvet cage of comfort,” and you tell yourself “I don’t want to venture out, because this is okay”. But Adam really drove the point home that we weren’t put on this planet to do okay – we were put on Earth to kick ass. Our parents were put here to do okay. We were put here because we’re tired of okay, and we want to kick ass and get to the next level. Sometimes this means doing away with “okay”.

Adam eventually used his expertise in carpentry to make connections that ultimately led to meeting Jimmy Kimmel and creating opportunity there.

My takeaway from his seminar was, leverage your skills, do what you love and hustle, even though you won’t be 100% sure it’ll succeed. Don’t settle for “okay” because were put on this Earth to be great!

I was actually thinking about buying his course since it was only $49.

Conclusion

If you’re okay with sales pitches, the event may be fun for you. You’ll have opportunities to network, and you’ll be able to see some big names. I personally wouldn’t go again, but that’s just me! However, what saved the day for me was seeing Tony Robbins for the first time and hearing some of his perspectives that actually inspired me to change some of my habits. I’ll post about that later!

If you checked out the Real Estate Wealth Expo, let me know your thoughts in the comments below.

Comments 11

Hi! Great write up! Can you please let me know the full url in the Carolla podcast flyer? It’s cut off in the picture.

Thanks!

Author

Thanks! http://carollaclass.online/ it looks like it is still available? If you end up getting it let me know if you enjoyed it, maybe I’ll purchase it as well.

it looks like it is still available? If you end up getting it let me know if you enjoyed it, maybe I’ll purchase it as well.

Well said! It was awesome. I was there too. I agree with you that most of the speeches were canned and it was clear the intent was to sell their programs and courses, but that shouldn’t offend anyone even if the courses are no good. It would be a waste and a shame if you were someone who had an opportunity to speak in front of thousands of people and you had no way to leverage it. Just my opinion on that!

I would have paid 3x the amount just for the celebrity speeches – Tony robbins for 4 hours, magic johnson, adam carolla, grant cardone for 2 hours, and pitbull for 45 minutes plus performing 4 songs. I came home AMPLIFIED with inspiration and still buzzing. You made a great point about the networking, too. I made a ton of business connections. I’m in digital marketing, not real estate, so the leverage for me was way higher than I think for most people there who were all selling the same thing.

But Tony Robbins, Pitbull, Magic Johnson, Adam Corolla, and Grant Cardone all gave so much value that I didn’t mind the minor leaguers selling their shtick. I still learned from most of them, even if what was to be learned was how to sell a course from stage. Get it?

Author

Yeah I think there was value, I’m still happy I went! And I’m totally okay with people upselling their products. It was just that I wished the speakers gave more valuable information before pitching their courses, cause I have been to a decent amount of seminars that provided a lot more value. But yeah, Tony Robbins was great and made it especially worth it!

Thanks for the breakdown Anthony. I bought the 2 for $100 and if the big names are speaking for that long it is well worth the money in my opinion. Question: Where they all on the first day or last day or both?

Great info – thank you! Did Tony speak on Day 1 or Day 2?

Author

Day 2!

This was great. I really felt like I went there and you gave me your actual opinion. I never really thought of Adam Corolla of inspiring but I’ll seek him out. Hope you’re doing well, Sharon.

Author

Thanks! Hope you’re doing well too!

Hi Sharon, great write up. I wish I would have read something like this 4 years ago, it would have saved me some money…Thanks again

Larry

Author

Thanks!