For the sixth episode of the DNQ interview series, I’d like to welcome Jay from FiFighter!

Quick backstory about how we met: After my 2014 Eurotrip, I wanted to figure out how to attain financial freedom, and I looked into real estate investment as one of my options. I signed up for this real estate investment community called BiggerPockets, where Jay was a member himself. Since he was from the Bay Area, he was willing to meet with me and discuss the basics. We became good friends ever since.

Upon meeting I learned that Jay was a financial freedom blogger who not only is an expert in real estate but also has a proven track record around investing in stocks! A lot of people are curious about day trading and long-term investing to earn money online while living abroad. I wanted to chat with Jay and see if he could provide any tips for beginners (like me)!

If you are looking into getting familiar with stocks, I’d say this interview is a great place to start as he’s packed tons of tips, explanations, and resources below. Without further ado, here is my interview with Jay from FiFighter.

How to Start Investing in Stocks with Jay from FiFighter

Sharon: Tell us about yourself!

Jay: Howdy! My name is Jay and I’m the founder of the blog FI Fighter. Although my background is in engineering, you could say that it didn’t take long for me to realize that this wasn’t something that I wanted to do for the long haul. I’ve always kind of been a free spirit who has never liked playing by any set “rules”. I would say that by around Year 4-5 of my career, I had figured out that the key to happiness was found through freedom of time and choice, not in a higher salary.

With that in mind, I started blogging in 2012 with the sole focus of trying to retire from Corporate America by the age of 37.5. To help achieve this goal, I went on a dual-pronged rampage to earn as much money as I possibly could from active income (I jumped around frequently to competing companies to earn higher salaries/bonuses/stock options, etc.) and to save even more of it. While the masses subscribe to Lifestyle Inflation, I did quite the opposite and focused on Lifestyle Deflation. With every extra dollar saved, I constantly invested any surplus into acquiring up as many assets as I possibly could.

This past March, at the age of 31, I decided it was time to walk away for good and try my hand at something else in life. I’m now currently living in Hong Kong, and I guess you could say I’m one of those Digital Nomads now, who is able to work location independent and come and go as I please. Life is awesome and I wouldn’t have it any other way.

Sharon: Do you have any background/experience in finance? How did you learn about stocks?

Jay: I’m just a retail investor with no formal background in finance. With that said, if I’m going to invest in anything, especially something as volatile as stocks, I think it’s necessary to study and read up as much information on the subject as possible.

I first got started in stocks by investing in my Roth IRA and 401k retirement accounts. I wasn’t doing anything fancy, and just sticking to index funds that tracked the overall markets. However, after a few years, I could clearly see this strategy working as my investments were compounding annually, and the overall portfolio value kept growing in size. In 2012, I tried my hand in Dividend Growth Investing (DGI), which is primarily a Buy and Hold approach that helps an investor earn passive income. With stocks, most of my education came from reading articles online, following other bloggers, and basically just getting in there and doing it myself. I’ve taken a few lumps along the way, but hey, how else do you learn in life? As they say, experience is the best teacher…

Sharon: For newbies, could you explain the concept of stocks?

Jay: When an investor purchases a stock, they are essentially buying an ownership stake in a company. What this implies is that as an owner, the investor has rights or claims to any profits and earnings that the company earns along the way. For example, if a company like Johnson and Johnson (JNJ) elects to return earnings back to its owners in the form of a quarterly dividend distribution, by owning shares, you will be able to participate and receive these payouts.

On the other hand, if we are talking about growth-centric companies who are focused primarily on rapidly expanding their business operations, like say a Shake Shack (SHAK), the upside for an investor will come in the form of share price appreciation; that’s the hope, anyway, as, growth-oriented companies typically won’t pay out dividends as they prefer to re-invest capital towards organic growth. If the said company is successful in creating value, its market capitalization will increase, which means that each individual share will become more valuable (assuming no further share dilution event), allowing the owner the option to sell back to the market for a profit. So, investors usually decide upfront if they want to buy stocks to earn a passive income, or if they are in it more for capital gains (share price appreciation).

However, there are certain companies out there like Starbucks (SBUX) and Apple (AAPL) that offer investors a kind of a hybrid of the two approaches presented above — These companies pay out a modest dividend and are still growing their businesses as a decent clip.

Sharon: Could you explain how stocks – day trading or long term trading – could be a lucrative route for those trying to work online while traveling?

Jay: Day trading allows a traveler the ability to earn some spare change by trading market volatility. With day trading, typically your buy and sell orders are executed and done with by the end of the day’s trading session. The most popular vehicle for day trading is to trade e-mini SP 500 futures contracts (ES). The ES is by and large the most liquid avenue for trading (it’s where the majority of day traders reside).

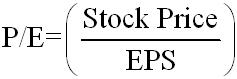

Of course, it’s not the only option for traders out there, as many prefer to trade things like: gold, silver, crude oil, cotton, currencies, etc. Future contracts provide a trader extremely strong leverage, so it’s possible to earn say $50/day to even upwards of $1,000/day, depending on how many contracts you’re trading with each order, and how many points you earn each session. The following chart shows that if a trader is successful in averaging 2 points/day, trading 5 contracts, they could in theory earn a gross income of over $100,000/year.

![]()

Whereas day trading is a means to earn active income, long-term trading is a more passive approach towards growing your initial capital investment. With long-term trading, you typically buy a stock that you think will appreciate in the future and you hold it until your unrealized paper gains exceed your target, at which point you sell and realize the profits. Depending on your own time frame, long-term trading can be very much a “set it and forget it” approach towards making money. For instance, a long-term trader could have bought a stock like Facebook (FB) back in 2012 for about $30/share, and held it until 2016, selling it back to the market for over $120/share. This would have turned an initial investment of $10,000 into $40,000. From 2012 until 2016, you would have had to do nothing except keep holding the shares. I don’t think there’s any hard and fast rules, but if I was to categorize long-term trading, I would say the holding period is at a minimum of 1 year for any stock positions.

Also, you have what is known as swing trading, or short-term trading, which is very similar to long-term trading, but the time horizon is much shorter. Typically the holding period for a stock is a few days, weeks, or months, but less than one full year.

Sharon: Many people think of this route as risky – what do you think about this?

Jay: Risk is relative! The most important thing anyone can do is to get sufficiently educated before they put at risk their hard-earned investment dollars.

Sharon: When you first started out, how risky were you? Were you scared?

Jay: Oh, absolutely I was scared! To this day, I still am scared because you never know what the markets will do. But I feel like I can temper the fear by making sure that I do sufficient due diligence to ensure that my investment thesis is sound. If I’m convinced my odds of succeeding are very high, I sleep well at night. With that said, I’ve been afraid with most everything that I’ve ever done in life: school, grad school, career, real estate, relationships, etc. Unfortunately, fear is something that comes quite natural to me!

Jay and his brother enjoying first class flights!

Sharon: How much would you say is the minimum dollar amount to get started?

Jay: Not much. An individual can get started with as little as $500 or $1,000. I would personally aim for $1,000+ per transaction to reduce the impact of any commissions/fees to your total cost basis, though.

Sharon: Have you seen success through investing in stocks?

Jay: Success is relative, I guess you would say. In 2015, I liquidated out of my 401k and booked about 100% realized gains. Essentially the same for my Roth IRA. In 2013, I traded shares of Tesla Motors (TSLA) and earned over $20,000. Again, it’s all relative, but I have made profits by trading stocks before.

Sharon: How long do you spend researching stocks each day?

Jay: When I’m first forming my investment thesis, I might put in 10-20+ hours on each company I’m researching. Once I feel comfortable with the underlying story and fundamentals, I tend to let my holdings run on auto-pilot. For the most part, I’m a long-term trader, so my time horizon between buying and selling is at least 1 year away, typically around 3 years or so. Because of the wide gap between buy and sell, unless the company’s fundamentals start to deteriorate, or if I feel like shares are getting overheated (too expensive), I usually don’t feel the need to have to do anything more than just wait. However, I might put in 3-4 hours each month on each stock I own, just reading press releases and digesting corporate presentations and things like that.

Sharon: What’s your stance on mutual funds and index funds? Could you explain what they mean?

Jay: A mutual fund is basically just a collection of stocks, bonds, or other assets wrapped inside of one container. So, for instance, instead of buying 50 individual stock positions, an investor would instead just purchase a SINGLE fund, trading under a specific ticker symbol that would hold those 50 stocks inside of it. From fund to fund, the number of companies, holdings, and asset allocation will vary. With mutual funds, these are typically actively managed which means that you’re paying somebody else an expense ratio (service charge) to try and outperform the market.

With index funds, you’re not trying to beat the market, per se, but rather your approach is to simply buy the market (e.g. SP 500, Dow Jones, Nasdaq, Biotech, Emerging Markets, etc.), whichever market that may be. It’s up to you. Because of this, index funds usually offer lower fees/commissions. The appeal with both mutual funds and index funds is that an investor doesn’t have to follow and keep track of a million different companies. In essence, you’re just buying a single, well diversified fund, which helps to greatly simplify the buying process.

In general I’m not a fan of mutual funds because the majority of them charge outlandish fees and commissions. However, I am a big fan of low expense ratio Vanguard Index Funds, such as Vanguard Total Stock Market Fund (VTSAX), which lets an investor track the broader US stock market for a low fee of just 0.05%. But to be clear, in 2016, I am not a fan of this fund, or most index funds and mutual funds at all as I feel that the overall stock market is trading at absurd valuations that are at, or approaching record highs. In other words, I’m a value investor, first and foremost, and I currently see no value in this space. For any long-term Buy and Hold Forever type of investors, though, I absolutely do feel that funds such as VTSAX are the gold standard for index investing.

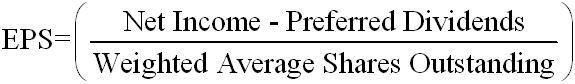

Sharon: What are some basic terms you think one should understand and could you explain them? (e.g. market caps, P/E ratio, etc.)

Jay: As a starting point, I think it’s important for newbies to familiarize themselves with some basic terms, which I covered in the following article.

Sharon: Do you think one should get a financial advisor to help with trading or trade themselves?

Jay: It depends on your own comfort level. For someone who is just starting out and feels overwhelmed, sure, I don’t think it would be a bad idea to consult professional help. But do keep in mind that there are seldom ever any free lunches out there; you will pay a hefty premium for any kind of outside financial services. My own personality is to do things myself, whenever I can, so I have no need or interest to consult with any financial advisors. But again, I have the time, bandwidth, and interest to do things myself.

Sharon: I’m quite the beginner when it comes to trading. For beginners like myself, what are some resources you suggest for us to study (like books or websites)?

Jay: For long-term, Buy and Hold Forever dividend growth investing, I would read The Single Best Investment by Lowell Miller.

For long-term, Buy and Hold index investing: The Boglehead’s Guide to Investing by Taylor Larimore

For general stock information: Seeking Alpha

For mining stocks: HotCopper, Stockhouse, CEO.ca

Sharon: What’s the easiest way to get started and begin trading? Is there a specific brokerage account you would recommend to newbies? Would they have to go into a bank and open an account or create one online?

Jay: To begin basic stock trading, you can open up a basic online brokerage account:

Charles Schwab, eTrade, TradeKing

I like Tradeking for trading your typical NYSE listed stock because they offer a low rate of $4.95/transaction for buying/selling ETFs and stocks. For penny mining stocks, I prefer Schwab Global since it gives me access to foreign markets, such as: Australia, Canada, London, etc.

Sharon: Any last words?

Jay: I just wrote this recently in an article, but perhaps it’s fitting to restate here:

The best time to buy assets is when others are disinterested and sentiment is excruciatingly negative! There is a ton more alpha to extract when an entire sector is in liquidation (see gold and silver mining stocks in 2015) as opposed to when momentum is gaining steam and everything (even the junk inventory) is being bid up to record highs!

With all that said, financial independence is just like life — an evolving journey. You will never have all the answers, and as the saying goes, “The best time to plant a tree was yesterday.” Most importantly, you only get one life so live the life you were meant to live. Tune out the noise, brush off the haters, and go after your goals with reckless abandon. Take care of those who treat you right and the universe will take care of the rest!

Wow! This ended up being an extremely comprehensive interview, so thank you Jay for participating and helping us newbies out! Since Jay is a master in all things revolving around financial freedom, I plan to have him on future episodes to discuss real estate, his thoughts on FI, and more – so stay tuned!

Resources Mentioned:

- Jay’s article on investing terms for beginners

- For information on long-term, Buy and Hold Forever dividend growth investing: The Single Best Investment by Lowell Miller

- For information on long-term, Buy and Hold index investing: The Boglehead’s Guide to Investing by Taylor Larimore

- For general stock information: Seeking Alpha

- For mining stocks: HotCopper, Stockhouse, CEO.ca

- To open up a basic online brokerage account: Charles Schwab, eTrade, Tradeking

- For penny mining stocks: Schwab Global

Comments 2

Sharon,

Thanks for the opportunity! Loving your interview series!

Author

Thanks Jay! Looking forward to meeting up in Hong Kong