In this post we go over how to make money on the stock market from home!

Investing on the stock market is an excellent option for people who are looking to expand their wealth. Investing in stocks allows your money to make even more money for you while you are busy with work, family, or friends.

The historical average annual return rate for the S&P 500 (the most important stock market performance indicator in the world) since its conception in 1926 is 9.8%, way higher than any bank savings account or the fixed income market may offer. While past returns do not guarantee future returns, 90 years of performance history is a solid precedent to consider.

There is a massive misconception regarding what you need to be profitable in the stock market. People often believe that to achieve results, you need to be in constant track of your stocks, implement intricate financial models, or adapt your positions regularly based on market trends and news. While this is true for riskier strategies and obtaining the very best results, that approach would not be adequate for most investors and even be counterproductive.

In this article, we are going to talk about what you need to start investing in stocks, which instruments better suits your needs, and why a more conservative but consistent approach is more profitable in the long run.

How to Make Money on the Stock Market

What Do I Need to Invest in the Stock Market?

People, in misbelieve, think that there is a huge entry barrier to start investing in the stock market, that they need a considerable amount of capital, sign a contract with a fancy brokerage firm and pay advisory fees. It used to be that way, but nowadays, online platforms offer investment options for anyone willing to set aside part of his income, spend some time to find the right solution for his needs and most importantly being patient.

Find a Broker

Full-Service Brokers

These are the traditional brokers, they offer a complete range of services like advising from certified professionals, personalized attention, retirement planning, etc. but that comes at a price as they charge for transactional fees, commissions from your earnings, and even membership fees. Full-service brokers often only deal with wealthy customers and ask for minimum investments of USD 25,000 and up.

Discount Brokers

They are the norm now; they give investors all the tools they need to make their own decisions. They act as an intermediary between the investor and the stock exchange, executing the instructions that the investor sends without interfering in the decision-making process.

Discount brokers also usually offer educational material and automated set-it-and-forget-it investment tools that can be very useful for long-term investment strategies.

Discount brokers don’t require a minimum deposit or a very low one, but instead, you may face additional commissions or restrictions if you don’t make a minimum investment.

Choose Wisely

Make sure to choose a platform that is backed by a proper financial institution and complies with the regulations of the country that is based, so you now your money is safe in case the broker goes bankrupt.

Beware of platforms that advertise themselves as fees-free, because, as economists like to say “There Ain’t No Such Thing as a Free Lunch”, these platforms usually add their mark-up on the stock price, selling the stock at a higher rate than other platforms and vice versa.

Serious brokers will also allow you to invest with a retirement account. A retirement account will provide taxation advantages, but will have other limitations like a maximum amount that you can invest using this method and the age that you have to reach to withdraw the funds.

Stock Market Vehicles

Individual Stocks

A share of an individual company represents a fraction of the ownership of the company in proportion to the total number of shares. For example, a company that issues 50 shares representing 50% equity of the company, if you purchase 10 shares, that will give you 10% ownership of the company, 10% voting power, and 10% right to receive dividends. But not all stocks are equal as they are often are issued without voting rights or preference to receive dividends.

All the financial information from companies that issue shares to the general public is free and available for anyone to analyze. The companies are required by regulation to update their information quarterly and release an annual report explaining their business approach and their plans for the future. That information needs to be built upon international norms and audited by an independent firm.

Most online brokers provide basic analysis information and provide you with educational tools that can help you to make your conclusions and decide if a particular company is worth your investment.

Mutual funds and ETFs Stocks

An investment fund is a supply of capital, owned by multiple investors, which is administered by a fund manager that uses the money to invest in a variety of securities. The intention of conforming these groups of investors is to take advantage of the more significant capital, to invest in a broader range of assets.

Investment funds managers will make investment decisions based on predefined goals like maximizing profits, reducing risk, focus on the long term, etc. They will also often invest exclusively in specific markets like derivatives, commodities, foreign currency, the technology industry, etc.

The shares of the investment funds will represent partial ownership of all the financial instruments that are held within the fund.

There are different types of investment funds and the terminology varies in each country, but these are the most important that you need to know:

- Open-end funds:

The shares of these funds are not traded publicly; they are sold and redeemed directly by the fund to the investors. When an investor purchases shares of an open-end fund, more shares are created to cover the necessity, and when an investor wants to sell their position, the shares repurchased by the fund are taken out of circulation. For that reason, the equity value of the fund is controlled in a way that always matches the net value of the assets that the fund possesses.

- Close-end funds:

The shares of close-end funds can be purchased and sold freely by the public on a stock exchange. Similarly, to regular companies, stocks from close-end funds are issued in an Initial Public Offering on a stock exchange to then be traded freely on the secondary market.

As the shares are subject to market tendencies, they can be traded at a higher price (known as a premium) or at a lower price (known as a discount) than the value of the assets that are held within the fund. That price difference represents the confidence that the market has that the fund administrators will manage the funds appropriately.

- Exchange-Traded Funds:

Better known as ETFs; combines characteristics of Open-End funds and Close-end funds. Their shares are traded on stock exchanges but operate making use of arbitrage mechanisms that keep the price of the shares close to the net value of their underlying securities.

Index ETFs attempt to replicate the performance of a specific index. They do this by holding in their portfolio the same assets as the index. As they are passively managed, meaning that they can copy the contents of a benchmark automatically, their operational costs are lower.

Investment funds allow the investors to invest in all the instruments that the fund has invested in. Modern ETFs also provide the option to buy on a margin and short an underlying asset.

CFDs

There are online platforms that offer the possibility to trade stocks with any amount and then providing benefits or losses based on the price difference between the time you bought it and the time you sell it.

While these can be useful tools lif you are looking to test the waters, you have to be aware that you are not investing in stocks, you are speculating on stock prices through a derivatives contract with the platform.

It is not rare that beginner investors purchase CFDs, thinking that they are trading the underlying asset. Make sure that you know exactly what your broker is offering, and you understand the difference between the two options.

Diversification and Risk Hedging

Having a diverse portfolio is vital for a successful investment strategy. All investments carry risks; the companies and funds will underperform at some point. Investing in a variety of securities will help you be prepared in case of a market correction, as it is unlikely that all industries will suffer a devaluation at the same time.

Diversifying in stocks can be challenging, especially if you have a limited budget. That is where funds are more useful, while returns can be lower than investing directly into the stocks, due to administration fees, they allow you to invest in a variety of securities that are managed by professional investors at the price of a single stock.

Don’t Try to Time the Market

The most important success predictor in the stock market is time. Markets tend to always grow in the long term, the longer you stay invested the higher your chances are that you can build a substantial profit, even when considering for inflation.

As mentioned before, the historical average return rate of the S&P 500 is 9.8% nevertheless, the average return rate for professional investors is 5.19%. That happens because humans make emotional decisions; psychological studies have shown that losing money hurts much more than the reward you feel when winning the same amount.

Stock prices don’t move based on objective facts; they move based on the expectancy that the investors have that the market will perform better or worse in the future. Investors will often overreact based on news, 82% of them think that they are smarter than everyone else, and have an innate ability to predict future outcomes.

Buy low and sell high, is the trading advice that we all have heard. But people, most of the time, will do the exact opposite. They will put money in the market when is going up thinking that is a “safe” time to invest, and when it is going down, they will often be afraid to invest.

People get into the stock market thinking that is their ticket to get rich fast, that’s precisely the reason why 90% of unexperienced investors lose their money, they naively think that they can outsmart the market and most of the time will fell prey to institutional and sophisticated investors.

Set it and forget it.

Stocks have a price difference between the buying and the selling price; this is known as the spread. This price difference makes it harder and harder to profit every time you trade a stock. For that reason, sticking to a long-term strategy is a more rational and profitable approach than actively trying to outsmart the market.

Modern online brokers will allow you to automatically invest a fixed amount of money on a particular fund or company at a predefined frequency. That, in conjunction with a retirement account, can be a very powerful combination for long term plans.

Let’s see how a real-life example of this approach would look like, using objective historical data.

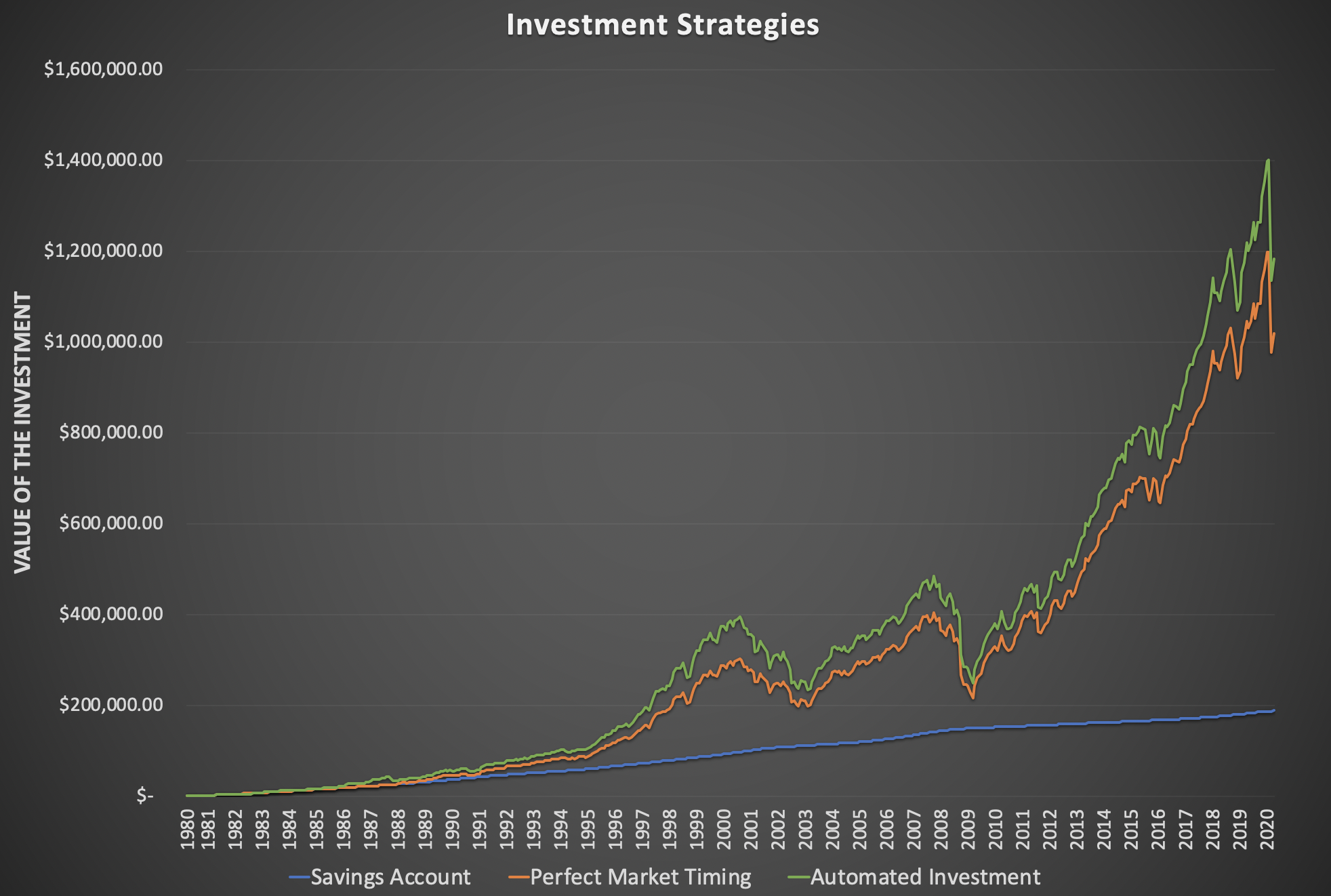

We are going to analyze three different investment strategies, in all of them, the contributions were the same, $200 per month for the last 40 years for a total investment of $96,000.

- In the first strategy, the contributions went directly into a bank savings account, the money was never taken out, and the interests always reinvested. If you started saving in May 1980, using this method, today you would have $187,127.17. You can see on the graph, how the investment would have performed in the 40 years, according to the passive interest rates available at the time.

- In the second scenario, the contributions also went into a savings account, but this time, waiting for the absolute best moment to invest in stocks, in this case, an S&P 500 index fund. If you would have applied this strategy perfectly, purchasing the stock when the prices were at the very bottom, investing the same $96,000,000 today you would have $1,017,543.85.

- Finally, in the last strategy, the investor did nothing. If you, had set an investment strategy 40 years ago, to automatically take $200 from your bank account and invest it in a fund indexed to S&P 500, today, you would have $1,183,886.44. Outperforming a perfectly executed market timing strategy.

The Bottom Line

Now that you know what it takes to start investing and the most common mistakes that beginner investors make is up to you if you want to take the challenge. Finding the right broker for you can be difficult, and the best fund or company to invest even harder, but once you are set, it’s just a matter of consistency and patience.

We hope you enjoyed this post on how to make money on the stock market from home! Let us know in the comments below if you have any feedback.