Teaching kids about money should be fun, but often, it can be daunting if you are a parent. This could be one reason why many parents leave it until late in life or never really make a concerted effort to educate kids about money.

In reality, there’s a lot to get through in the realm of money, and it can’t all be crammed into one sit down conversation with the kids.

Rather, money and financial discipline are topics you will come back to again and again in the course of educating your kids. If you leave it until later childhood, your kids might already have picked up the wrong financial lessons from TV or the world around them.

The Center For Financial Security notes that kids form a significant portion of their ideas about money between the ages of 6 and 12.

The best time to teach kids about money is to begin as soon as they can use money to buy things like candy and have exposure to the use of money. As they mature and eventually go on to college, the lessons you teach them will evolve to reflect their greater financial aptitude.

Wrong Methods For Teaching Kids About Money

Your attempts to educate your kids about money can go wrong if you use the wrong approaches.

As much as knowing what to do or say, you should also avoid these common mistakes when teaching kids about money. Failure to do so can sabotage your efforts at sound financial instruction.

First, don’t make the mistake of avoiding discussions about money entirely. If you do so, your kids might feel that money is a dirty topic and they do not need to learn about it. In later life, such attitudes can make it harder for them to learn the financial self discipline they should have mastered earlier on.

Secondly, don’t leave this important job of teaching kids about money to the school teachers and friends. Your kids’ friends are likely to be as clueless about money as they are, so they need the voice of someone experienced in the ways of earning and saving money.

As great as teachers at school are, they are probably more concerned about basic math and reading skills to pay much attention to the topic of money. That such an important topic is routinely ignored is, perhaps, just another glaring weakness in the education system.

Best-selling author and personal finance icon Robert Kiyosaki advises parents not to leave it up to the schools to educate kids about money. In his own experience, school did not teach him much about this important topic, but his “rich dad” did.

Teaching Kindergarten Kids About Money

Kindergarten is an ideal time to familiarize kids with simple money lessons. At this stage, kids are young, and any attempts to educate should have an element of play.

Keep that in mind as you plan and carry out activities with your kindergarten kids to educate them about money.

At an early age, kids will be unfamiliar with the coins and bills so you can start by familiarizing them with the names of the units of money. Since kindergarten kids learn better from pictures and other visuals, you should print out flyers as well as other colorful illustrations. Show them the images of the items next to the items themselves.

You can begin teaching them how buying something works by using role play with yourself as the storekeeper. The kids will come to you to buy toys and other play items.

Teach the kids how to make drawings of money, including coins and bills.

You should pay special attention to supervise the kids when working with coins. Very young kids might be naturally inclined to try to swallow the coins. Keep coins away from these very young kids and only introduce them as kids get old enough to know not to try mouthing the money.

Teaching K-12 Kids About Money

The K-12 education years involve tremendous growth for kids. Naturally, this is where you will have the bulk of your opportunities to teach them about money and instill financial discipline.

The types of lessons and activities you can conduct in the elementary school years depend on the age of the kids. During the K-5 years, you can focus on teaching the importance of saving money, good shopping habits, and other personal finance fundamentals. Lessons with storytelling, such as Uncle Jed’s Barbershop teach about money in a fun way. This is a lesson plan suitable for ages 9 to 11. It tells the kids how a small business owner saves up money to invest in a barbershop business.

Kids in the 6th grade and up can learn from the entertaining Warren Buffett’s Secret Millionaires Club. This animated series will teach kids about money management, debt, credit cards, and running their own business.

In grades 9-12, you need to reinforce important personal finance skills as kids work towards high school graduation. Budgeting for expenses, finding ways to earn money, the importance of saving, and investing all make good themes to teach your kids during these years.

Teaching Kids To Save Money

Saving money, and forming the habit of saving regularly, is one of the most important money skills you can teach kids over the years. The tools you use to teach the skill of saving will change over time, but you must start early.

At young ages, when kids are just beginning to learn the importance of money, it’s common to use a piggy bank. Many parents now prefer to use a clear container so kids can see how much money they have saved. If your kids are pre-K, however, the novelty of a colorful piggy bank will do more to engage them. At that young age, it’s just another cool toy, and they will get used to throwing the occasional coin in for the excitement of it.

As kids enter grade school, you can begin to set savings goals with them. For example, you can both decide upon an amount they will deposit in their piggy bank each week or month. On important occasions like birthdays, you can gather their savings, add something of your own, and buy them a prized gift. This way, they see the practical benefit of all the saving they’ve been doing over time.

Since kids are more impatient and want rewards faster, make the rewards frequent. You wouldn’t want to go an entire year before showing them the payoff of saving otherwise they lose interest.

As kids grow older, you will want to take them to the bank and open a formal bank account for them. This will add to their feeling of accomplishment and spur their commitment to a life of saving.

Teaching Kids To Earn Money

Saving money, as important as it is, is just one pillar of the essential money skills. As kids move through grade school and on towards high school, they must learn how to earn their own money. If done right, this will prepare them for a life of work and instill habits of hard work that serve them in professional careers.

Some families like to have the kids do chores around the house for a fee. This can be an easy way for kids to learn about earning money since they don’t need to go find a customer to sell something to.

Once kids are old enough to move around the neighborhood on their own, you can get them mowing lawns for other people. In the winter, they can shovel driveways and clear snow.

The opportunity to work around the neighborhood will also help them meet other kids doing the same, and make friends.

Other early money-earning activities, such as bake sales and baby-sitting, will depend on natural inclination. Car washes are another popular money-earning activity for kids, but it depends on your location.

Teaching Kids Good Shopping Habits

From the age when kids are able to start spending their own money, they need to learn good shopping habits. Saving money and earning more of it must be complemented with good buying habits to ensure they get maximum use from each dollar they own.

With young kids, you can start small, by letting them try samples at the local grocery store if these are offered. Kids will start to learn that you don’t just buy food or other items, but look for quality and certain standards in exchange for the money you pay.

Once kids are old enough to learn about buying good deals, take them to local farmers’ markets where produce can be found relatively cheaply. Teach them that they can get more for their money by shopping at these markets than expensive stores.

You can use lessons like this comparison shopping lesson from Bright Hub Education to help kids become savvy shoppers.

Take time to teach the kids the difference between wants and needs. Show them why they must prioritize essentials over luxuries. Also teach them handy buying tricks such as shopping used or looking for discount sales to buy at a discount.

Games For Teaching Kids About Money

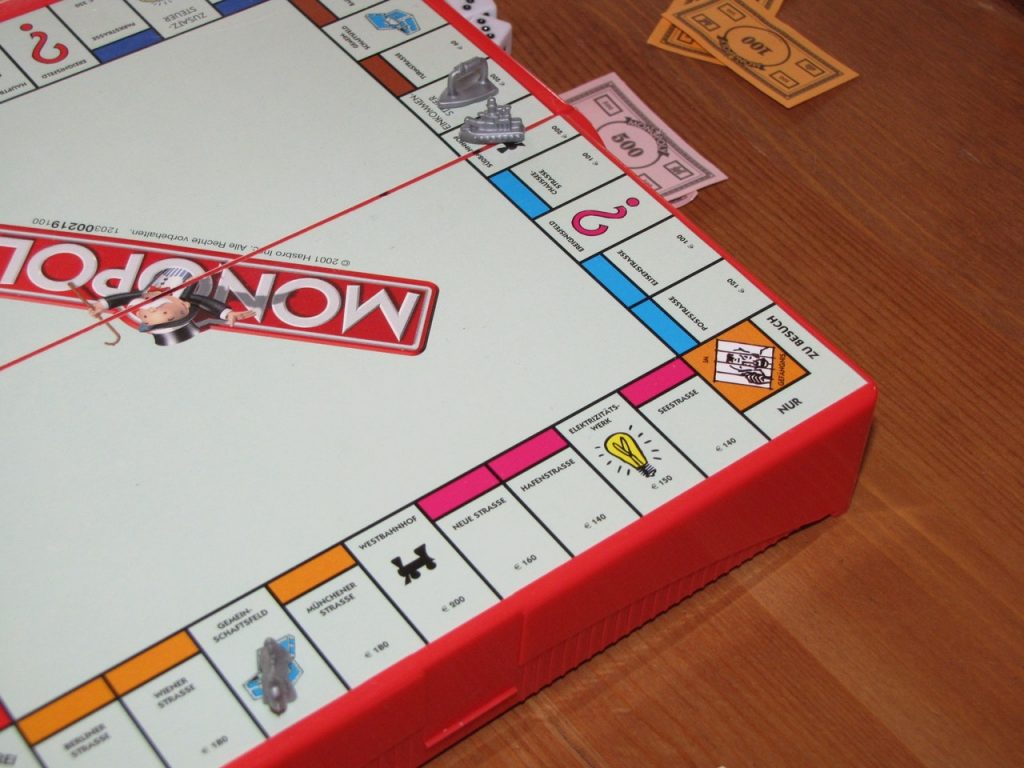

Games remain one of the best learning aids for kids. This is because games introduce an informal, fun environment where making mistakes is allowed. As a result, kids feel relaxed enough to spend a lot of time on games, even when the lessons they teach are quite complex.

Money games come in handy for financial education. You can start with Monopoly, one of the classic games that teach personal finance acumen.

In Monopoly, you compete with others to get on in the board’s “world” and control properties so as to acquire the most financial gain. Monopoly teaches kids the importance of financial management and the avoidance of bankruptcy.

Other games like Pay Day can add to the lessons and enjoyment kids get from playing Monopoly. Explaining the rules of these games to kids will also give you a chance to throw in good financial lessons for the kids.

For older kids, consider investing games, like The Stock Market Game, for teaching stock market investing.

Apps That Help You Teach Your Kids About Money

Classic board games are all well and fine for teaching kids about money, but these days many kids like to spend more time on their mobile phones.

Rather than let the time kids spend on mobile phones go to waste, download the right apps for their financial education.

Kids Money is one of the leading apps when it comes to teaching kids about money. The app lets kids set saving goals and plan their future purchases. By using the app, your kids will realize they are in control of their finances and can achieve financial goals.

Another app, Savings Spree, promotes saving-focused financial habits in kids. It does this by rewarding decisions that result in money saved, rather than those that waste money.

To help kids learn how banking works, you can use Bankaroo. This app is a virtual bank for kids, complete with attention grabbing graphics designed to make banking fun for kids. Kids can set savings goals in Bankaroo and work towards achieving them.

For smarter shopping, Renegade Buggies is a great option. The app teaches kids to look for bargains by using a game environment where kids need to save money to win.

Celebrity Calamity is another exciting game app for teaching thrift and sound money management. In the game, kids must manage the finances of a celebrity and prevent the celebrity from going broke. This helps kids learn to conserve and preserve money, as well as to take the long range view when spending money.

Teaching College Kids And Older Kids Financial Discipline

When your kids reach college age and assume more independence, the financial skills you have taught them become even more important. Your job is by no means finished as a model of good money skills. You still need to reinforce and promote sound money management.

One of the important basics that can serve college age kids well in the years ahead is the practice of sticking to a budget. You can work with your college freshman to budget their money and make sure they have enough money on hand in case of a rainy day.

Introduce your college aged child to online financial services, such as Mint, so that he or she can make budgeting even more convenient. Mint allows your kid to review their spending and see how they are performing against their saving goals.

To foster your college kid’s ability to fend for themselves, you should encourage them to get a campus job to pay for their lifestyle. This will also improve their financial picture, with income coming in each month on a consistent schedule.

Summer vacations from college can be a great time for your kid to get ahead financially. Encourage them to seek summer internships and jobs so they can make extra income. Guide them to use this income in responsible ways, such as paying off tuition loans, saving up for college textbooks, or for the future.

The Value Of Teaching Kids About Money

By making the time and being intentional about it, you can steer kids on the path to a better financial future. Teaching kids about money starts early and evolves over the years. Young kids learn through games and fun activities. As they get a bit older, you will implement a variety of activities, discussions, and opportunities for them to exercise financial responsibility. From helping them earn money through summer jobs to building up their savings accounts, your guidance is invaluable for your kid’s success with money.