I’d like to dedicate a post on what the FIRE movement is and the basics of how to attain it. To many this may be a new term, but not a new concept (especially if you’ve familiarized yourself with this blog). FIRE means Financially Independent, Retire Early. I only learned about this terminology maybe a year ago and didn’t realize there was an actual acronym around the concept (and even a Reddit page for it).

I’ve always been interested in removing financial burdens to design my best life. This whole blog basically talks about this exact thing – achieving financial freedom so you can create your life to exactly how you want it to be. I believe in hitting passive income and net worth goals in order to pursue your passions without worry. The FIRE movement makes you think about the concept in such a way where you have exact numeric goals you want to hit so a day job becomes optional.

What is the FIRE movement? The Basics of the Financially Independent, Retire Early Trend

The FIRE movement is a simple model – you’re essentially trying to save a majority of your income to put into low-fee investments like index funds. Normally people retire in their 60’s, as around 62 is when you can start taking benefits allowed by the Social Security Administration.

With FIRE you’re retiring in your 20’s-40’s so your savings and investments cover your expenses for the rest of your life.

People generally break down FIRE into two components:

FI: Financial Independence

Being financially independent means you have saved a decent nest egg and/or you’re making so much in passive income that it consistently covers your monthly expenses. You’re able to stop working for money while maintaining your lifestyle. This concept can be achieved in a few different ways, but most financial freedom fighters talk about saving up 25 times your yearly spending and investing that money. For example, if you want to spend $36,000 a year, you’ll need about $900,000 saved up and invested. Theoretically, every year you’ll take out 4% of the total to live off and because of your investments, the principle won’t dwindle (more on that later).

RE: Retire Early

Rather than retiring in your mid 60’s like most people do, you’re retiring earlier perhaps in your 20’s-40’s so that you have more time to live your life. Retiring early can mean different things to different people – you may or may not still be working a full-time job. You could even be self employed, or you could have a bunch of passive income streams that cover you where you don’t have to really work anymore. It really depends on you, but the idea is you’re designing your life so that you aren’t dependent on working until an old age. You can make your life how you want it to be without the consideration of finances, and it doesn’t necessarily mean you have to quit your job in order to achieve it. Perhaps you may find you actually want to be at your day job! It’s whatever you choose. Ultimately, “financial independence doesn’t mean that you have to quit your job. It just means that your job needs you more than you need them,” said Deacon Hayes, author of You Can Retire Early!

4% Rule and the Equation for Retirement

I think one of the most common and confusing questions is “How much do I need to save for retirement?” Earlier I mentioned the 4% concept that equates to saving up 25 times your yearly spending and investing that money.

Anita Dhake who retired at 32, explains how the 4% rule works:

“I use the 4% rule which has been written about pretty extensively. Theoretically, my investments will increase 7%/year on average and inflation will be 3% per year/average That means, theoretically, I can pull out 4% and the principle will not dwindle. Projected passive income is just that 4% rule.”

After Dhake saved $700,000, she decided that this nest egg was enough to retire off of based on the 4% rule, equating to around $28,000 yearly spending. She put the majority of her savings into Vanguard Total Stock Market Index Fund (VTSAX) which is a pretty safe index fund that pays out dividends. So theoretically, her investment should give her the $28,000 each year that she needs without dipping into her $700,000 principle.

The 4% safe withdrawal rate is an ideal concept, as you can argue that stocks go up and down, investments can tank, etc. But if you look at historical trends, 4% is actually a pretty safe number as argued by Mr. Money Mustache.

Your Savings Rate

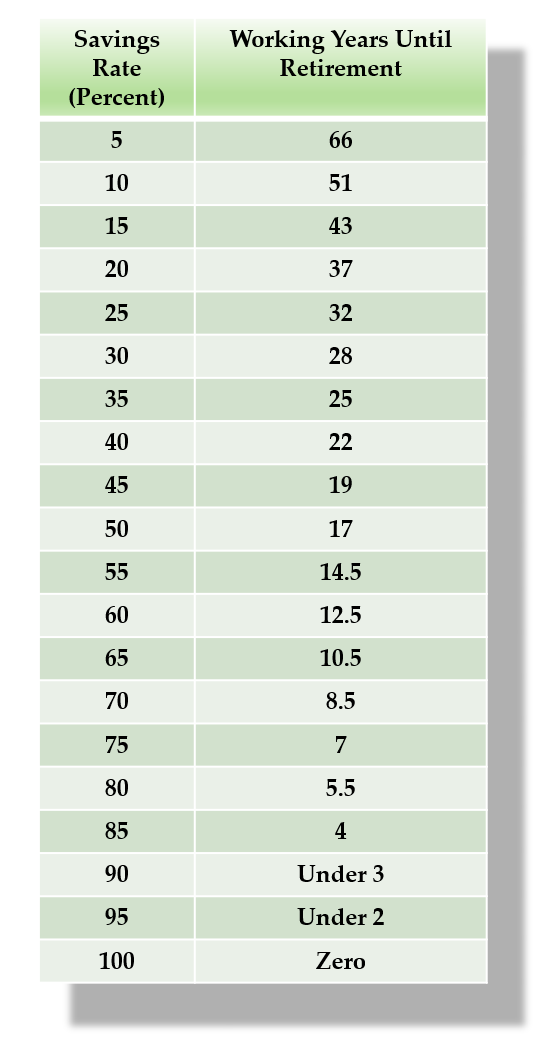

Another way to think of your calculated retirement goal is by figuring out your savings rate as a percentage of your take-home pay (as referenced by Mr. Money Mustache)

These two graphics are also from Mr. Money Mustache and assume a net worth of 0. If you’re thinking of your retirement number as this percentage and assume that your spending remains quite consistent through the rest of your life, you can calculate your years to retirement that way.

So in reality the simple equation is all about your income and expenses. How much money are you taking home and how much are you spending? If you spend 0% of your income, you can retire now while if you spend 100% of your income, you’ll never retire.

My Personal Outlook…

Personally, I worry about depending solely on the 4% rule or calculations based on the savings rate percentage. I agree with and trust the principles, but I am just a worrier by nature! I also realize “retirement” for me doesn’t mean I’ll stop working. I’ll be completely bored and lost if I spent my days doing nothing productive or meaningful. I would definitely be working on projects and probably accruing passive income as a byproduct, even if increasing my cashflow weren’t the goal.

The 4% rule doesn’t take into consideration passive income streams you may already have in place, money collected from social security, and inheritances.

Therefore, building passive income streams (as promoted by this blog) ensures the 4% is merely a security blanket and minimal baseline that you can build off of. Once I’ve achieved a specific nest egg/net worth that covers my 4%, I’ll still be pursuing passive income streams so I’m 99% sure I’ll never have to worry again.

Technically, I could safely retire now and live in southeast Asia where expenses are around $600-1000 a month. Because of my passive income streams, I would even make money in the process. If I sold my investment property here and used the 4% rule combined with my passive income streams, I could POSSIBLY retire now in America. However I’d have to be careful with my spending and I’d probably worry about the consistency of my passive income streams. I’d have to adopt the lean financial independence life, and I wouldn’t consider it a 100% guaranteed financially free life.

So as you can see, I’m not really there yet. I’m still working on increasing my income and net worth. Having a bit of passive income coming in, however, changes how everything feels. I feel less stuck in life and more filled with options. It’s a great feeling not having to freak out if I ever lost my job (not to say I wouldn’t regardless). Having multiple income streams and a FIRE goal makes life feel expansive and limitless.

How to Achieve FIRE

Save Money

FIRE really hones in on savings and expenses as the main numbers to consider.

If you’re planning to focus mainly on the savings part of the equation, you might consider living more frugally and minimally. A lot of FIRE fighters are into minimalism and lowering expenses. It’s preached about in most finance books. Even “Rich Dad Poor Dad”, one of my favorite books, talks about the rat race fear/desire cycle – that the more the average person earns, the more the average person spends. As we make more money, we desire all the nice stuff we can now afford. And because that money gives us all these unnecessary things, we are more afraid to lose it and all the nice stuff that comes with it, so we work tirelessly for money.

Minimalism focuses on what you actually need rather than all the unnecessary stuff you want in your life that creates clutter. As Marie Kondo puts it (the author of The Life-Changing Magic of Tidying Up) – only hold items that spark joy in your life. As I traveled the world, I noticed I only needed one backpack and carry-on for those 2 years. We really don’t need that much stuff to be happy. By being minimal and focusing on necessities and items that spark joy, we spend less and have less attachments.

Reducing Liabilities and Recurring Expenses – After focusing on your needs versus your wants, you can figure out what monthly subscriptions can be reduced or removed. Do you really need that daily coffee? That expensive gym membership or subscription to a magazine? Can you house hack so that you can reduce your monthly rent, or can you downsize so that your mortgage isn’t insane? These are factors worth considering in order to achieve FIRE.

Track Your Net Worth – If you’re especially focused on the savings part of the equation, I suggest using Personal Capital to track your net worth and debt online. It is free to sign up and it automatically updates your account balances. As you start seeing your net worth increase, it’ll add motivation to save (as well as increase your income)!

Increase your Income

I’m pretty frugal and minimal in ways. But I also like to experience life and find extreme frugality can be restricting. Especially with my added passive income streams, I find I spend a bit more now (am I falling into the Rich Dad Poor Dad fear-desire cycle?!) However, I still save a large majority of my income, and I’m still building my passive income streams. I’ve been trying to increase the amount of income I get, so that I can achieve a financially independent life that doesn’t require meticulous calculation of whether or not I’m in line with my 4% rule, etc.

Conclusion

It’s time to really start thinking about financial independence/early retirement a bit more. We all have passions and things we want to do in our life before we die. We should really take a closer look at our finances and how we can live a bit more intentionally towards the life we want! This is why I think the FIRE movement is awesome. It’s open to interpretation in ways – you can still work a job if you want. But with FIRE, work needs you more than you need it.

Comments 2

I LOVE THIS POST. I was a huge FIRE nerd from when I started working until “retired” to “live the way I wanted.” Now I agree 100% with your sentiment of going for FI through CASH FLOW rather than saving up a big nest egg to do the 4% rule.

The thing I love most about the cash flow method is that if you set it up correctly – as it seems you are – then cash will continue to flow even after you die. That’s a great inheritance gift.

Author

Yessss! Exactly. Thanks for your comment!