When it comes to managing your finances, it’s important to understand what money is coming in and out. It’s vital to start tracking your net worth if you want to start improving your financial journey.

But tracking your net worth can be tedious. It may be hard to track everything with many spreadsheets, and it’ll take long to update. But if you have everything recorded in bank accounts and credit cards, why not link the information?

This is why I recommend using Personal Capital. It takes a lot of the hassle out of manually inputting the numbers to calculate your net worth. Personal Capital is a site that tracks your net worth and debt online. Best of all it is free! It automatically updates your account balances. The great thing about checking your net worth is you can track how far you are from your financial goals and adjust your strategy accordingly. And when your net worth increases, it’ll serve as positive motivation to save and increase your income.

Sign up for Personal Capital here (free).

How To Use Personal Capital To Track Your Net Worth

What is Net Worth Tracking?

Before we talk about Personal Capital, we should talk about net worth tracking and what it is. Net worth tracking is one of the easiest, most innovative ways to be financially aware and smart in terms of finances. Essentially, net worth tracking is the term coined for the frequent assessment and analysis of your net worth, spending, and financial health.

It can be done by hand using brain power and the ever-popular, pencil and paper method. Or, it can be done with the help of an app, program, or professional.

Reasons To Track Your Net Worth

Good motivation to reduce debt.

When tracking your net worth, it’s crucial to write down and assess your liabilities. This can be great motivation to get your debt paid off and to avoid gathering more. Whether it’s the sheer number of liabilities that you have or the overall sum of money that these liabilities rob you of that has you wanting to run for the hills, you’re bound to want to change your financial ways.

Although the debt of one liability may not be very good motivation, the sum of student loans, a mortgage, a credit card (or two?), and personal loans might be.

Indicates the state of your overall financial health.

Net worth is the most relevant metric for measuring the status of your financial situation – it gives you the bigger picture. Your net worth puts liabilities into perspective. For example, even if you have some student debt, you might still be in an overall good financial state due to your assets.

Can be a useful tool for getting a loan.

Sometimes, knowing your net worth might help you secure a loan. A solid, unwavering net worth can help lenders feel comfortable enough to approve your loan application. It might also help you to snag a lower interest rate. This being said, though, a low net worth might work against you instead of with you.

Measures your financial progress.

If you have a net worth goal that you want to hit before retirement, net worth tracking is a great way to measure your progress. By tracking your net worth, you’ll be able to assess how far you are from your goal at any given time. If you aren’t progressing fast enough for your liking, you’ll be able to correct it quickly and get on track.

Helps you make wise financial decisions.

Even if it does nothing more than showing you where you need to improve, seeing your progress on a monthly basis through net worth tracking can be a fantastic motivator. It can help you file your financial decisions into the appropriate (and more important) categories: decisions that reduce liability, and decisions that increase your assets.

What Is Personal Capital?

Personal Capital is a handy tool that has been specially designed to help users monitor their finances. In addition to tracking your net worth, it also keeps tabs on your spending habits, investments, and standing debt. It collects and stores all of your financial information in one easy-to-access place so that you can get the full picture.

Reasons To Use Personal Capital

24/7 customer service

Personal Capital offers its users 24/7 customer support. The support team can be contacted through email or phone.

Offers a cash savings account.

Personal Capital, in addition to its financial monitoring services, also offers its users the option of signing up for a cash savings account. Once established, this account offers unlimited cash withdrawls and has no minimum balance requirements.

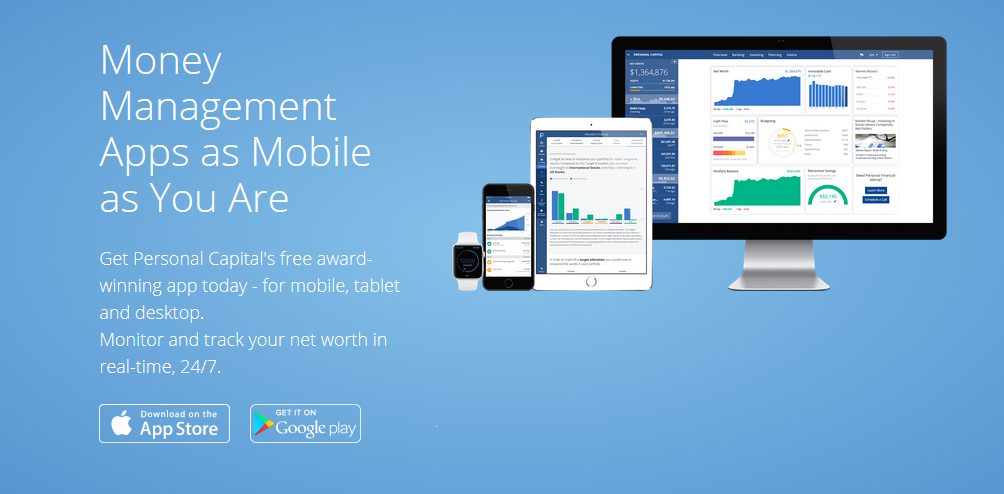

Easy to use on the go.

Personal Capital can be accessed by mobile app, making it incredibly convenient and simple to use when out and about. The app is available for both iOS and Android devices, with both apps being free to download and access.

Secure and safe.

Taking pride in the safety of their customers’ information, Personal Capital ensures the security of financial and personal information through a number of measures including:

- A read-only platform that prohibits withdrawals

- Military-grade encryption (256-bit AES)

- Perimeter security

- Firewalls

- Fingerprint scanning for iOS devices

- Around the clock monitoring

- Requires device registration for each new device you use

The registration factor for each device, in addition to initial registration, also requires the occasional re-registration to keep information as secure as possible.

Retirement planner

Included in the use of Personal Capital is a feature known as the retirement planner. It bases its given information on a range of “what if” scenarios that are designed to help users determine their progress and where they are in the process of reaching their financial goals.

It can be adjusted based on the personal situations going on in a user’s life, for example, a career change, new baby, buying a home, or saving for a college fund. The retirement planner takes into careful consideration the range of external factors that could impact retirement.

Helpful bill reminders.

If you’re forgetful, Personal Capital can really come in handy as it can remind you of upcoming bill payments. It will send you a notification containing your:

- Due date

- Amount due

- A statement of your balance

3 levels of service.

Personal Capital offer three levels of service depending on your balance. The first level, for those with a balance of $100,000-$200,000 is called the Investment Service. This level offers 24/7 call center support, access to a financial advisor, tactical weighting, and an ETF portfolio that is tax-efficient.

The second level, called the Wealth Management Service and serving those with balances of $200,000 – $1 million offers customizable ETFs and stocks, personal financial advisors, college savings, retirement and financial plans, tax loss harvesting, and all of the perks mentioned for the first level.

The third service level is called Private Client and caters to balances of greater than $1 million. This level offers everything mentioned in the above two levels and private banking, priority financial advisor access, an estate attorney, and hedge fund investment reviews and private equity.

How does it work?

The process starts with a free consultation. During this, an advisor or team of advisors will create a personalized strategy just for you. Then, the software completes the investing and maintenance for your portfolio. If your situation changes, though, you still have unlimited access to the financial advisors. They are able to make adjustments for you.

How to Use Personal Capital To Track Your Net Worth

Getting Started with Personal Finance Tracking

Managing your finances can be a complicated process. It requires serious attention and plenty of time, but thanks to the development of apps like Personal Capital, it’s now the easiest that it’s ever been.

Tracking with Personal Capital

Personal Capital is similar in appearance to many other financial apps on the market. Personal Capital is most appropriate when investments and other financial assets need to be evaluated across various accounts. The easy to navigate app helps you to understand where your money goes, see the status of your investments and how they perform, and lower your excess spending by, on average, 15%.

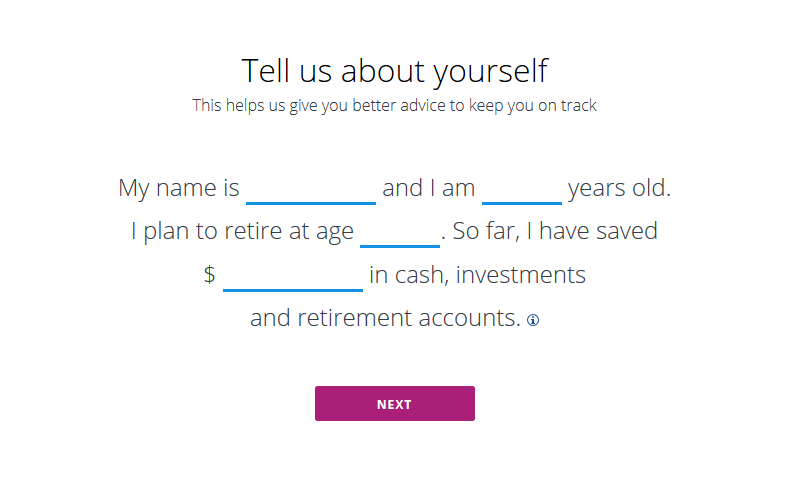

To set up your Personal Capital account, you need to start by paying a visit to the Personal Capital website. Here, you’ll sign up. As part of the sign up process, Personal Capital will ask you to set your retirement goal, as well as assess the value of your current retirement savings. Later, this information will be useful.

Account Linking

In order to get the necessary data into the app, you’ll need to link all of your accounts. You can add accounts for brokerages and financial institutions including the major establishments and smaller-scale establishments.

If you have any concerns about the use of your personal information, you can rest assured that it is safe and secure. Personal Capital uses military-grade encryption to ensure the integrity of your information.

Once your accounts are linked and your Personal Capital account is complete, you’ll be presented with a snapshot of net worth through your dashboard. This area, your main dashboard, will show you a chart that showcases the changes that your net worth has undergone over time. More specifically, it will show you changes within the last 30 days.

Tracking Your Portfolio

Investments are exciting, right? Right. That’s why Personal Capital showcases them in a way that is easy to read and understand. It displays your portfolio holdings in a chart so that you can see the performance of your investments. This area showcases not only your overall portfolio holdings but also individual allocations that are worth looking into.

Tracking Spending and Cash Flow

The Cash Flow tab is where you’ll see, in diagrams and charts, how you have been spending your hard earned cash. The charts are split into two sections: income and spending, which gives you a good picture of the areas in which you might be overspending. When you click on the Cash Flow tab, you can see charts for how you have been spending your cash. The cash flow charts can be split into income and spending, which gives you the opportunity to see where you may be overspending.

The figures shown give you an idea of how much income each of your sources bring in, as well as how much spending you’re doing. The spending portion includes paying bills such as mortgages.

Saving Time and Simplifying Your Finances

Tracking your net worth with Personal Capital is fast and fairly straightforward. The huge advantages include saving you time and making it simple to have your financial information in one place. You no longer need a collection of spreadsheets for budgeting and multiple different apps for working with your investments. With Personal Capital, all your net worth information becomes easy to digest.

FAQ

Does Personal Capital serve international customers?

Unfortunately, Personal Capital only supports US banks and institutions at this time. However, the company is working to expand their range. Any international customers that sign up will be notified when services become available in their country.

Can I pay bills using the bill reminder feature?

No, this feature is only for reminders.

How often is Personal Capital updated?

Every night around midnight, Personal Capital updates the accounts of users. In addition, it also updates each time users log in, for a total of once every 4 hours.

How to Sign Up

To sign up, visit Personal Capital and sign up for free!

If you are serious about changing your financial situation and making large strides to get rid of debt, this is the app to do it with. It’s very important to track your finances if you are serious about changing your life to be more financially conscious. As you start using Personal Capital, you’ll begin to see where your money is going in and out and whether or not you can make adjustments to hit your goals. If you enjoyed this post, let us know your feedback in the comments below!

Comments 2

Are there sites that track non- traditional assets, such as your rental properties, that aren’t tied to a financial institution?

You can actually add your rental properties through using their Zillow estimate tool and then integrating your account with your mortgages for the liabilities!